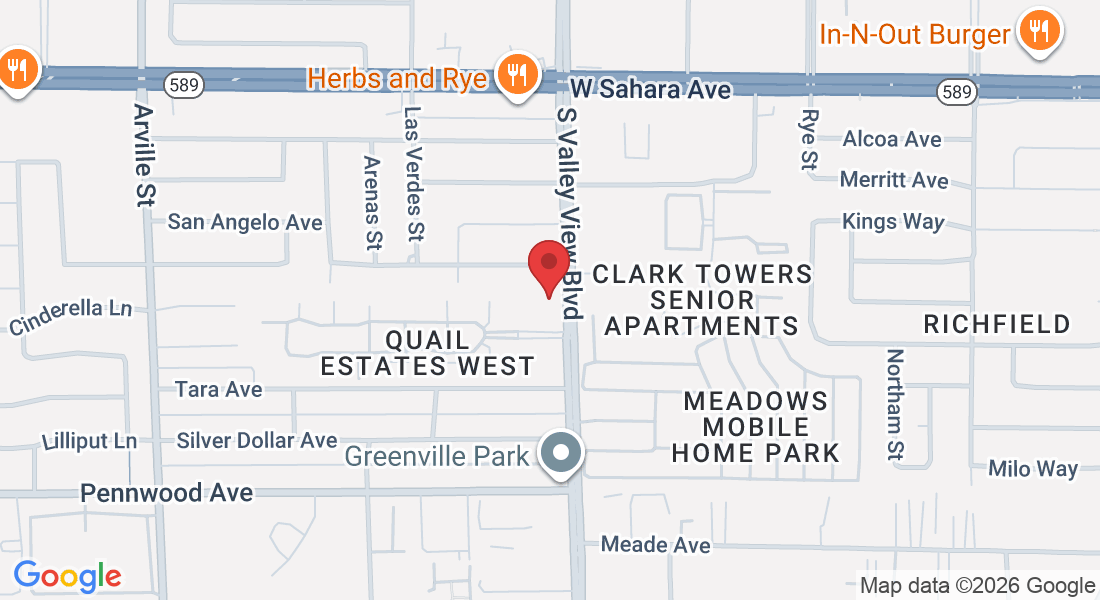

(702) 685-1111 | 2801 S Valley View Blvd Ste 6

Get in Touch with Sonia's Tax Services

Our dedicated team is ready to provide you with the information and support you need. Feel free to reach out to us through the provided contact methods, and we'll get back to you promptly. Your feedback and questions are valuable to us, and we look forward to hearing from you. Thank you for considering Sonia's Tax Services as your trusted partner in tax and financial matters.

Testimonials

Sonia is the Wonder Woman business owner, she represents an honorable standard and team to support it, they are extremely efficient, and have been in the business for over 15 years! I highly recommend this business to anyone.

GINGER N.

. I love this place and I recommend it to everyone who asks me about tax services. She's the best in Las Vegas and also has thee most reasonable prices. Quick and efficient I'll never go anywhere else ever again. Also, they speak Spanish!

DENNIS C.

Sonia's Tax Service has helped me for the past three or four years and I couldn't be more happy filing my taxes without them. I'm an independent hairstylist and doing my taxes any other way is a struggle. Usually I stress over paying my taxes but Sonia has guided me in the best ways possible.

NATHALIE O.

FAQS

What types of tax services do you provide?

We offer a comprehensive range of tax services, including individual tax preparation, business tax services, tax planning, IRS audit support, and more. Our experienced professionals are equipped to address various tax needs.

Are your tax professionals certified or licensed?

Yes, our tax professionals are certified and licensed. They undergo rigorous training to stay updated with the latest tax laws and regulations to provide you with expert assistance.

How do I prepare for my tax appointment?

To prepare for your tax appointment, gather your financial documents, such as W-2s, 1099s, and other relevant records. Review our tax preparation checklist on our website for a comprehensive guide.

How can I maximize my tax refund?

Maximizing your tax refund involves proper tax planning and knowledge of available deductions and credits. Our tax professionals will work with you to identify opportunities for tax savings.

What should I do if I've received an IRS audit notice?

If you receive an IRS audit notice, don't worry. Contact us immediately, and we'll guide you through the process. Our experienced team can assist with audit support and help you respond effectively.

Do you offer e-filing services for tax returns?

Yes, we provide e-filing services to make the tax filing process more convenient. E-filing is secure, efficient, and often results in quicker refunds.

What is the difference between tax credits and tax deductions?

Tax credits directly reduce the amount of tax you owe, while tax deductions reduce your taxable income. We'll explain the distinctions and help you leverage both to your advantage.

What do I do if I've missed the tax filing deadline?

If you've missed the tax filing deadline, it's crucial to file as soon as possible to minimize penalties and interest. We can help you with late-filing strategies and explore any available extensions.